Medicare Supplement Plan Broker

Independent Agents | Competitive Pricing | Free Consultation

Medicare Supplements in Bradenton & Sarasota, FL

As you may know by now, Original Medicare pays for a lot, but not all of the costs for covered health care supplies and services. Medicare Supplements, also called Medigap policies are sold by private insurance companies. They can help pay some of the additional costs for covered services and supplies like copayments, deductibles and coinsurance. Some Medigap policies also offer coverage for things Original Medicare doesn’t cover such as medical care when you travel internationally. Keep in mind that Medigap policies do not cover long-term care, vision, hearing aids, dental care, private-duty nursing or eyeglasses.

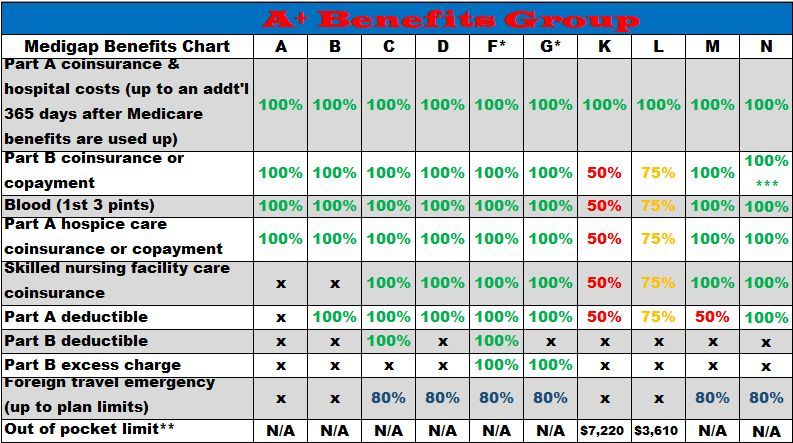

Medicare Supplements are standardized which means that each “lettered” plan offers the same coverage no matter who the insurance carrier is. For example, Medicare Supplement Plan G with carrier ABC would have the same coverage as Medicare Supplement Plan G with carrier XYZ. There are a few states where Medigap policies are standardized in a different method.

There are several lettered plans available for purchase, however, as of 1/1/2020, Medigap plans sold to people new to Medicare cannot be allowed to cover the annual Part B deductible. For this reason, Medicare Supplement plans C and F are no longer offered. If you were eligible for Medicare before 1/1/2020 but did not enroll in Medicare, you may be able to purchase one of these plans. If you are already enrolled in plans C or F, your coverage continues and you can keep your plan.

There are several Medigap plans available for Medicare beneficiaries and choosing one can be confusing. Our Medicare specialists at A+ Benefits Group can help you understand the different plans and the coverage each plan includes. Although the best time to buy a Medigap policy is during your Open Enrollment Period (the 6th month period when you are turning 65 and enrolled in Part B), you may have additional Open Enrollment Periods in which to apply for a plan. Your costs for the plan may be higher in this type of situation though.

Medigap policies cover only one person and you are required to make your monthly payments for Medicare Part B and your Medigap plan in order to stay enrolled. Medigap policies cannot contain prescription drug coverage and companies are not required to sell policies to people under 65.

For a FREE consultation on Medicare supplements in Bradenton and Lakewood Ranch, FL that me be available to you, and to have all your questions answered regarding the Medicare maze, contact a Medicare Supplement Plan Agent at A+ Benefits Group.

* Plans F and G also offer a high-deductible plan in some states. With this option, you must pay for Medicare-covered costs (coinsurance, copayments, and deductibles) up to the deductible amount of $2,850 in 2025 before your policy pays anything. (Plans C and F aren't available to people who were newly eligible for Medicare on or after January 1, 2021.)

** For Plans K and L, after you meet your out-of-pocket yearly limit and your yearly Part B deductible ($257 in 2025), the Medigap plan pays 100% of covered services for the rest of the calendar year.

*** Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to a $50 copayment for emergency room visits that don't result in inpatient admission.

Share On: